Presents

Follow Us on Twitter

20

Inspiring

Keynotes

Memorable

Experience

500+

Aspiring

Participants

Connect and Network

By Mehul Jiyani

SEBI Registered - RA

By HItesh somani

MD - Aapka Investments

Building Algo Trading and

Automation for ant Trading

systems using chatgpt and

AI tools

Why Choose us

Investors Insights

Finding the right stocks

with potential CAGR.

Determine the Intrinsic

value of the stocks.

Approaching the market

at anytime to enter and

exit with a profitable trade

Applying Quantitative

Analysis to Hedge the

portfolio value

Topics Covered

Investors Insights

Monthly series Expiry Trading

Trend view for Month using Stock

and Index Derivatives

Trend view for Month using

Stock and Index Derivatives

Targeting Month weekly

index series option strategies

and Adjustments

Agenda

Meet the Speakers

Mr. Vishal Mehta

Vishal Mehta ,CMT is chapter chair for Mumbai for prestigious Chartered Market Technician(CMT).

He has experience with all the major technical and financial information company in India likes of Spider software, Reliable software, Financial Technologies, Thomson Reuters & Bloomberg.

He has been also featured as profitable trader in money control.

He is managing 500cr of prop fund

Mr. Santosh Pasi

He is the founder of Pasi Technologies & Sonic Alpha

He has been a trader in the Indian stock markets with an overall experience of 15 years, specializing in Options Trading while focusing on volatility.

He is a non-directional option strategy trader, considering volatility as an edge using both system (algo trading) and discretionary

He manages the tool OptionsOracle, an options strategy analysis tool.

He has also trained over 1000+ participants across India and other parts of the world.

Mr. Rajandran R

Rajandran R, is a Creator of OpenAlgo - OpenSource Algo Trading framework for Indian Traders.

Telecom Engineer turned Full-time Derivative Trader. Mostly Trading Nifty, Banknifty, High Liquid Stock Derivatives.

Trading the Markets Since 2006 onwards.

Using Market Profile and Orderflow for more than a decade.

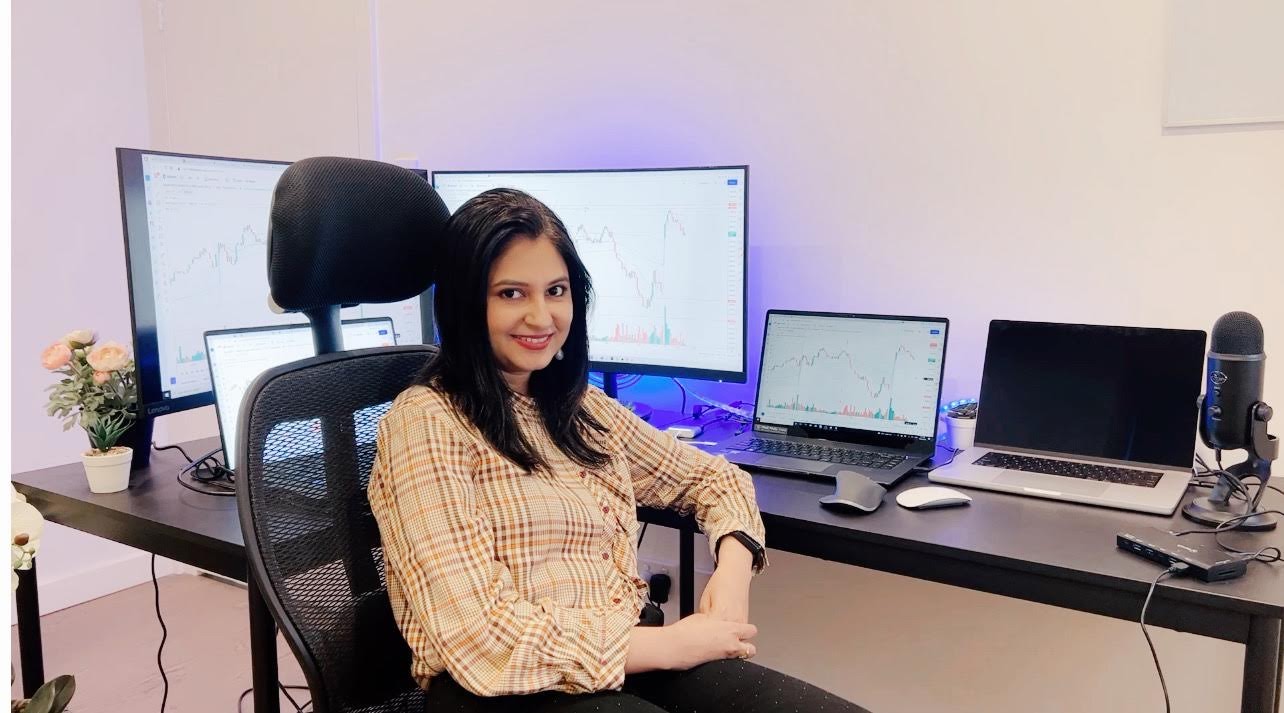

Ms . Kavita

I am (Kavita) SEBI Registered Stock Market Research Analyst with an industry experience of 10+ years.

I have expertise in investing and trading. I specialize in Index Option Derivatives, Cash markets, Futures, and Commodities. I do thorough research and analysis, primarily data analysis, market research, aiding in strategic decisions on stock purchases. In Intraday.

I mainly focus on Options Trading. I pick my trades purely based on Price Action, how much risk I will take, entry point, and Risk: Reward Ratio.

I have been featured in Money Control, The Hindustan Times, The Economics Times, and Josh Talks.

Mr. Kushal Jain

Co-founder Algofox

Trading since 10+ years, Managing a personal portfolio of 1.3cr, Quant and option Greeks specialist

Guest faculty in 40+ college of Bangalore

Speaker in Money control sessions

Created best selling course for learnapp

Recognised by ZEE BUSINESS

created 10+ free courses on stock market

Created 150+ algorithms for HNI and prop desk traders

Mr. Sathish Kumar

Sathish is the Founder for Creating Wealth Company, he has helped more than 10,000 investors by increasing their Networth & Wealth through his Investment Advisory from Direct Equities | Stocks | Mutual Funds | PMS | Unlisted Stocks | Bonds.

Author of Financial Series “Middle Class to Millionaire” in Nanayam Vikatan • Author of Financial Series “Target Crorepathi @ 40” in Nanayam Vikatan

Mr . Nagaraj Balasubramaniam

With a background that includes a DCG, AMPFSCM from IIM Lucknow, and a BE, also holding an NCMP - NSE Academy certified Market professional

My professional journey spans 20 years as a trader, where I've experienced the highs and lows of the markets firsthand. Over the past 12 years, I've transitioned into a mentorship role, guiding aspiring traders and investors to navigate these complex waters

One of his proudest achievements is holding the record for the Longest Financial Lecture by an Individual in the India Book of Records. This accomplishment is a testament to my dedication and passion for financial education

Mr. Gomathi Shankar

He is Founder & CEO of Scalpers Trading Academy

He have a passion for teaching and mentoring people who want to learn the financial markets in a simplified way.

customized training sessions covers day trading, short term & long term investing, financial planning and wealth creation.

Mr. Naveen gladstone

Naveen Gladstone is a seasoned professional in the field of capital markets, leveraging an educational background with a B.E. degree. With over a decade of experience since 2015,

he has carved a niche as an algo trader,

specializing in designing intricate trading strategies using data-driven models. His expertise extends to risk-defined systematic option trading, a

skill honed through his role as Co-founder of Bright Minds Quant Firm.

patterns, developing sophisticated algo strategies, and imparting knowledge on technical patterns and option strategies.

His passion for education is evident through his mentorship of over 150 students, equipping

Mr . Pratheesh R

Former Assistant Professor | Full-Time Trader | Market & Volume Profile Specialist

Background: Pratheesh R transitioned from academia to full-time trading seven years ago, leveraging his analytical skills and economic expertise in the financial markets. He spent a decade teaching before discovering his passion for trading.

Trading Focus: Specializes in Indian Equity & FNO markets, focusing on Nifty 50 Index and select large-cap stocks

Trading Methodology: Pratheesh's trading strategy revolves around volume profile analysis, which he believes provides crucial insights into market structure and participant behavior.

His approach includes: Identifying key levels: Using volume profile to pinpoint areas of high trading activity and potential support/resistance

Mr . Rosario D

As a Chartered Accountant with a deep-rooted passion for financial markets, started his journey with Deutsche bank as Financial Analyst in 2014 and become Full time trader in 2019 Started Simply Options, a cutting-edge quantitative trading firm.

With a Over a decade of Experience in Markets and a commitment to data-driven decision-making, His primary goal was to explore the intricate patterns

hidden within financial data, He leverage the power of the Law of Large Numbers to craft innovative trading strategies that seek to optimized returns with Ultra-low

Mr . Deepak K L

With over a decade rooted in Financial Investment and Trading within stock markets, Deepak undertook his trading journey in 2012. Starting as a full-time trader, he sharpened his skills in investment techniques and crafted unique models that denote him in the industry.

Deepak's expertise extends beyond trading; it encompasses an innovative investing model that places him among the most successful investors and traders. His prowess in money management and risk assessment consistently yields doubled investments in an astonishingly short span of 3-4 years, defying market expectations.

Transitioning seamlessly from trader to mentor, Deepak takes pride in sharing his knowledge. He has trained numerous trading professionals, offering comprehensive guidance that transcends conventional norms.

Organizers

Last Editions

Who can attend this Event?

Fund Managers

Novice Traders and Investors

Prop Desk Traders

Algo Traders and Investors

Get Tickets

Visitor

Free

OFFER

Limited to 100 Seats

Unlimited Water For Hydration

Theater Setup

High Tea

Lunch Coupon

One - One Speaker Q&A

Networking

Brainstorming

Business

₹ 5000

₹ 9,999

50% OFF

Limited to 100 Seats

Unlimited Water For Hydration

Theater Setup

High Tea

Lunch Coupon

One - One Speaker Q&A

Networking

Brainstorming

Cocktail Pary

VIP

₹ 15,000

₹ 29,999

50% OFF

Limited to 100 Seats

Everything Under Business Ticket

Unlimited Cocktail Dinner Party (6:00 PM - 10:00 PM )

Unlimited Brainstorming Sessions with Speakers

Unlimited Snacks & Food Through out the day

Exclusive Access to ONE - One Meeting With Speakers

Media Partner

In the news

Venue Partner

Event Partner

Any Questions?

T&C Privacy Policy Refund Policy FAQ

DTray FinTech LLP copyrights reserved © 2024